Apple’s (NASDAQ:AAPL) Q2 Earnings Beat Estimates — Here Are the Numbers

Apple just announced its Q2-2024 earnings results, which beat both earnings and revenue expectations. Here are the numbers.

EPS of $1.53 vs. $1.505 expected. This is up 0.66% year-over-year, as last year’s Q2 EPS was $1.52

Revenue of $90.75B vs. $90.366B expected. This is down 4.3% year-over-year, as last year’s Q2 revenue was $94.84B.

Board authorizes added buyback program worth $110B — 4.1% of its market cap and the largest in its history.

Raises its dividend by 4.2% to $0.25 per quarter (previously $0.24)

Free cash flow came in at $20.694B vs. $25.644B in the same quarter last year, down 19.3% year-over-year. TTM FCF of $101.95B

Q2 wearables, home and accessories net sales of $7.91B vs. $8.08B estimate

iPhone revenue of $45.96B vs. $45.76B estimate

Here’s a breakdown of Apple’s income statement, courtesy of @EconomyApp on X

And here’s AAPL’s free cash flow trend over the past 10 fiscal years, not including the TTM FCF of $101.95B

Buybacks Boost AAPL Stock

AAPL is up 7% in after-hours trading, and one major reason is likely the $110B buyback authorization. Buying back shares reduces the company’s outstanding share count, boosting EPS, which can boost the stock. Here’s AAPL’s historical buyback yield.

Apple Expects a Return to Sales Growth Due to AI

Tim Cook stated that he anticipates Apple to see sales growth in the current quarter (which ends in June) as the firm is investing in AI features that will be announced in the coming months. Overall, he expects revenue to grow by low-single digits, and analysts expect 1.3% revenue growth to ~$82.9B.

Is AAPL Stock Undervalued?

Let’s do some calculations to see if AAPL stock is undervalued.

TTM free cash flow of $101.95B

TTM FCF per share = approximately $6.59 using the most recent share count

9.4% discount rate (cost of equity), taken from Finbox.

Terminal growth rate of 3%

After-hours share price of $184

So, is AAPL stock undervalued? Using our reverse DCF calculator, the market is pricing Apple to grow its free cash flow per share by 10.295% annually for the next 10 years and then by 3% every year after that. See the image below.

Basically, if you think AAPL can surpass that growth rate, then the stock is undervalued, and vice versa. For reference, AAPL’s free cash flow per share growth over the past five years comes in at ~15.8%. However, FCF per share has been flatlining recently, so expecting a 10.3% growth rate may be slightly optimistic. Take a look at its FCF per share below.

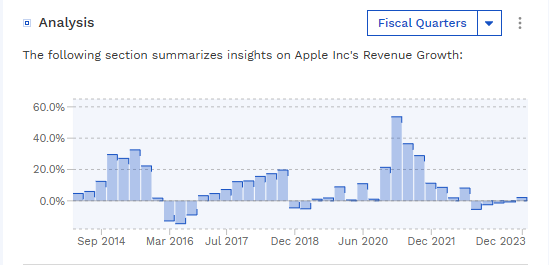

Its sales growth has also been coming down. See the chart below.

AAPL’s historical revenue growth as a %. Source: Finbox

Summary

Apple beat earnings and revenue expectations and is expecting sales growth again in the current quarter because of AI. Its earnings grew slightly, but its revenue and free cash flow fell year-over-year. While the big buyback is nice, the overall valuation doesn’t look enticing, even though AAPL is a great company. Expecting 10%+ FCF per share growth for this company is hard when its sales have been having a hard time growing recently.

Thanks for reading. Check out our other calculators by clicking here