PayPal Stock (NASDAQ:PYPL): Is It Worth Buying after Earnings?

PayPal reported its financial results for the first quarter of 2024, which beat both EPS and revenue expectations. The company even changed the way that it’s reporting its non-GAAP earnings. Below, we’ll go over its results in detail and perform a reverse DCF valuation on the stock (read more about our reverse DCF calculator here). We’ll also go over its technical and fundamental trends. Overall, PYPL isn’t convincing enough for us to be worth buying, as it has some issues, but it doesn’t look horrible.

How Did PayPal Perform in Q1?

Revenue Beats Expectations: PayPal's revenue for Q1 2024 reached $7.7 billion, marking a 9% increase year-over-year. This growth exceeded the estimates, which were set at $7.512 billion.

Non-GAAP EPS Beats Expectations (kinda): PayPal's non-GAAP EPS increased by 27% to $1.08, driven by a 14% increase in total payment volume (TPV) and a 4% growth in transaction margin. This non-GAAP EPS includes an adjustment to its reporting method, which now includes stock-based compensation expenses and related employer payroll taxes, making it more conservative. Using PayPal’s previous non-GAAP EPS reporting method would give you EPS of $1.40, which beat the $1.22 estimate.

GAAP Net Income: The company reported GAAP net income of $888 million, which represents a 12% increase from the previous year.

Operating Income: PayPal's operating income saw a significant rise, reaching $1.168 billion, up by 17% year-over-year. This improvement contributed to an operating margin expansion from 14.2% in Q1 2023 to 15.2% in Q1 2024.

Cash Flow from Operations: The cash flow from operations was particularly strong, increasing by 64% to $1.917 billion, indicating solid financial health and cash generation.

Free Cash Flow and Share Repurchases: The company generated $1.8 billion in free cash flow in Q1 and completed $1.5 billion in share repurchases, bringing total share repurchases over the past 12 months to approximately $5.1 billion. That’s a buyback yield of 7% at its current market cap of $72.5B.

Total Payment Volume (TPV): TPV experienced a 14% increase, reaching $403.86 billion.

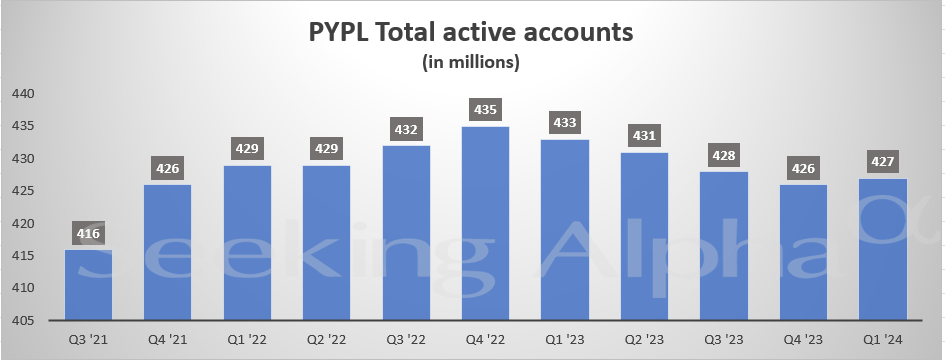

Active accounts: Came in at 427 million, down 1.4% year-over-year and up 0.2% quarter-over-quarter. See the trend of active accounts below, which finally ticked up after several quarters of decline.

PayPal Expects Lower GAAP Earnings, Higher Non-GAAP Earnings YoY

GAAP: Despite the positive performance, PayPal anticipates a decline in GAAP earnings for 2024, projecting GAAP earnings per diluted share to be approximately $3.65, down from $3.84 in the previous year. Last year’s GAAP EPS included a $0.24 gain from on its Happy Returns sale and $0.14 from its investment portfolio. These are one-offs, so let’s look at its adjusted (non-GAAP) forecasts.

Non-GAAP: As per PYPL’s press release, “Non-GAAP earnings per diluted share expected to increase by a mid to high single-digit percentage compared to $3.83 (based on the new non-GAAP methodology) in the prior year.”

Customer Strategies and Investment Priorities

Here’s a bit of what the company said in its conference call:

Large Enterprises: PayPal is focusing on accelerating growth in branded checkout and driving profitability. The company is executing upgrades to its core branded checkout experiences and has seen promising results from its Fastlane by PayPal product, with returning users converting at nearly 80%.

Small and Medium-Sized Businesses: The launch of PayPal Complete Payments (PPCP) has been gaining momentum, with the platform now available in over 34 countries. PPCP ensures merchants have the latest branded checkout integration, which includes Fastlane, providing a “best-in-class” checkout experience for consumers and benefiting merchants with higher conversion rates1.

Consumer Front: The PayPal app is central to the company's strategy, with a revamped look and feel, enhanced rewards programs, and testing of a comprehensive rewards-focused lifecycle marketing program. The app's onboarding flow enhancements have led to a 38% increase in debit card first-time users, with customers who adopt the debit card being more engaged, generating a 2x lift in transaction activity and a nearly 20% increase in average revenue per account1.

So, Is PayPal Stock Undervalued?

Over the past 12 months, PayPal’s free cash flow has totaled about $5.02 billion. Using a weighted average diluted share count of 1.072 billion gives us free cash flow per share of $4.683, which we’ll use in our reverse discounted cash flow valuation for PYPL stock. It also gives us a price/FCF multiple of 14.84x, in case you were wondering.

Reverse DCF Valuation inputs:

FCF per share: $4.683

Cost of equity (required rate of return): 12.5% — this was taken from Finbox

Current share price: $69.50.

Terminal growth rate: 3%

As you can see below, our reverse DCF calculator states that the market is pricing PYPL stock to grow its FCF per share by 7.6% per year for the next 10 years and 3% every year after that. Essentially, if you think the company can surpass that growth, then it’s undervalued, and vice versa.

Now, it’s very possible that PayPal can grow its FCF per share by 7.6% or greater in the next 10 years. However, investors need to also consider that its FCF per share trend in the past few years (not including this most recent quarter) was mostly flat (see below).

This is due to crazy competition in the fintech space, which has also led PayPal’s gross profit margins lower over the years (see below). So there are definitely some caveats that come with PayPal’s low market-implied growth expectations.

PYPL Stock: Is It Entering an Uptrend?

Quickly looking at PYPL stock’s weekly chart, we can see that bearish momentum has slowed down; it has crossed over its 50-week moving average and is starting to make higher highs and lower lows. This could be the start of a sustained uptrend, but we’d like to see more confirmation first. As of right now, it looks like the closest major resistance level is near $76, so there’s some short-term upside potential there.

The Takeaway

Overall, PayPal’s results seemed good, and the company’s total active accounts ticked higher finally after months of decline. PayPal is a cash flow machine, and it uses this cash flow for buybacks, which are good at creating shareholder value, especially since the stock is now trading at a much lower valuation than it has in the past. At its current valuation, it looks like the market is pricing in 7.6% FCF per share growth for the next 10 years, which is reasonable. However, there’s plenty of competition in the space, evidenced by PayPal’s growth slowdown and gross margin contraction.

So overall, while PYPL doesn’t seem like a bad stock at this juncture, we think there are “easier” opportunities for the long term that are more predictable and suffer less from competition.

In the short term (on a technical basis), PYPL has bullish momentum and can potentially reach $76.